COVID-19 VACCINES

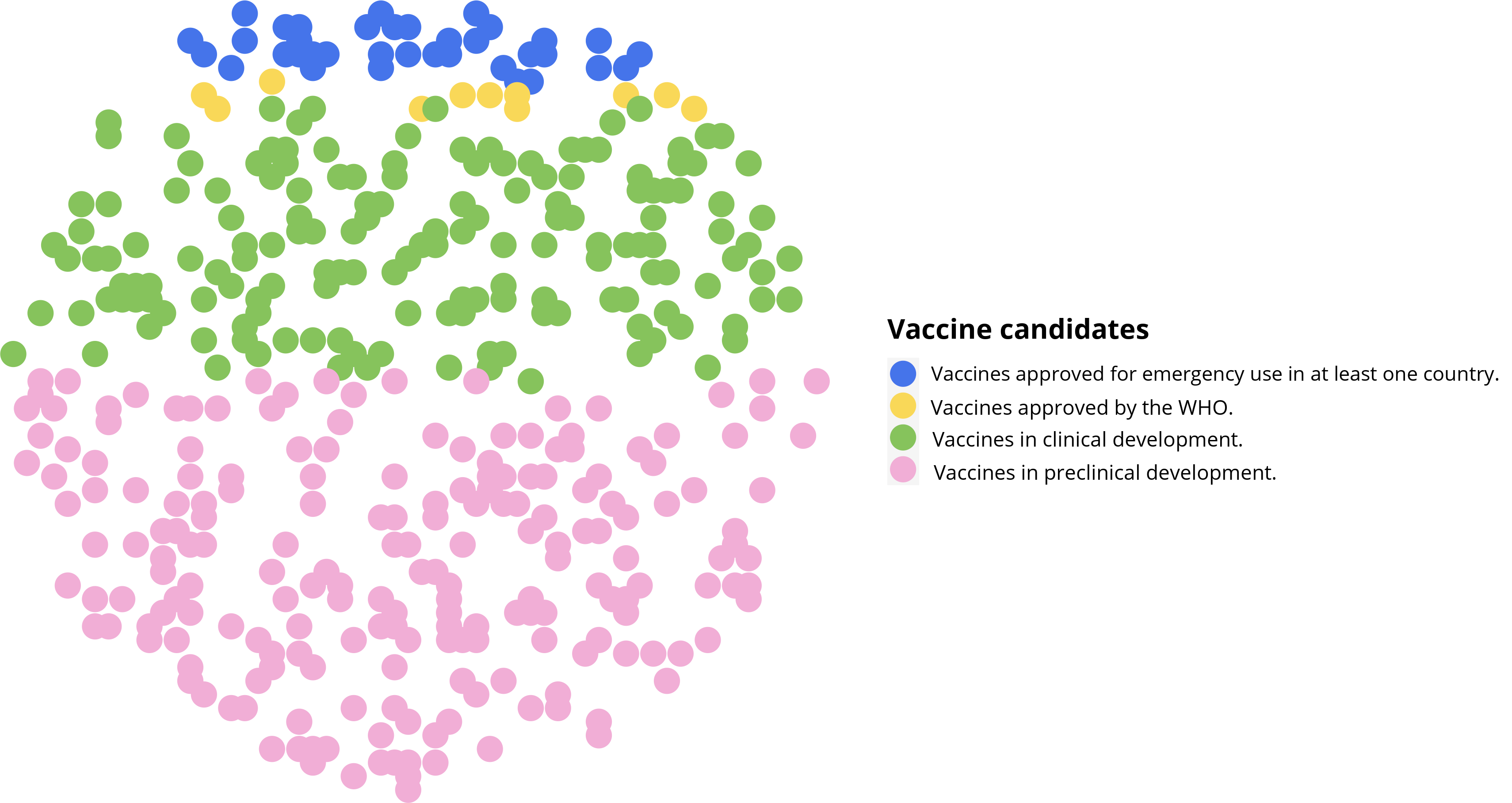

According to the World Health Organization (WHO) as of May 25, 2022, there were 198 vaccine candidates in preclinical development and 157 vaccine candidates in clinical development. Of developments that have completed or are close to completing clinical trials, the UNICEF COVID-19 vaccine market dashboard shows that 36 have been approved for emergency use in at least one country, and of those 11 vaccines are on the WHO emergency use list.

The pharmaceutical industry is highly concentrated

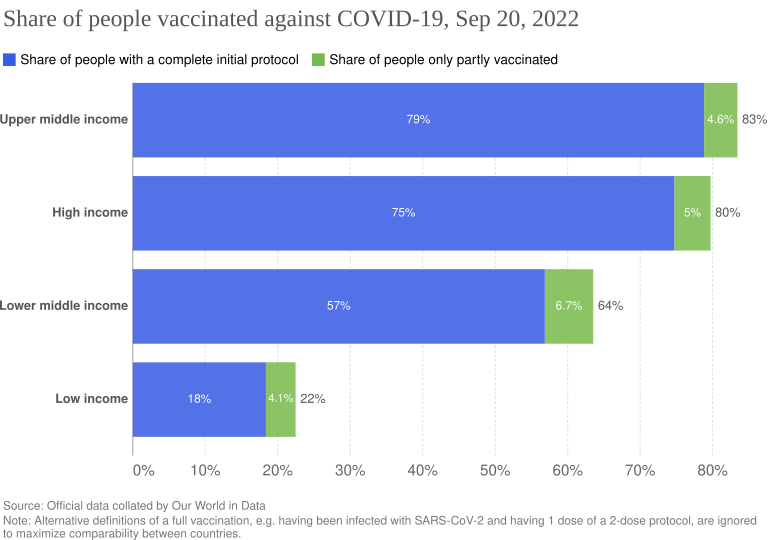

This industry operates practically as a monopoly. The 20 biggest laboratories worldwide concentrate 60% of the pharmaceutical industry’s global sales. These companies have the power to influence global health policy placing their profits before human lives. While in high and medium-high income countries more than 80% of the population has been vaccinated, in low-income countries the figure is barely above 20%. As regards new treatments, By late March, Pfizer had produced 8 million treatments of its antiviral drug Paxlovid, of which almost all shipments were for use in the United States, Canada, Japan, some countries in the European Union, South Korea, Israel, Australia, and the United Kingdom, all high-income countries.

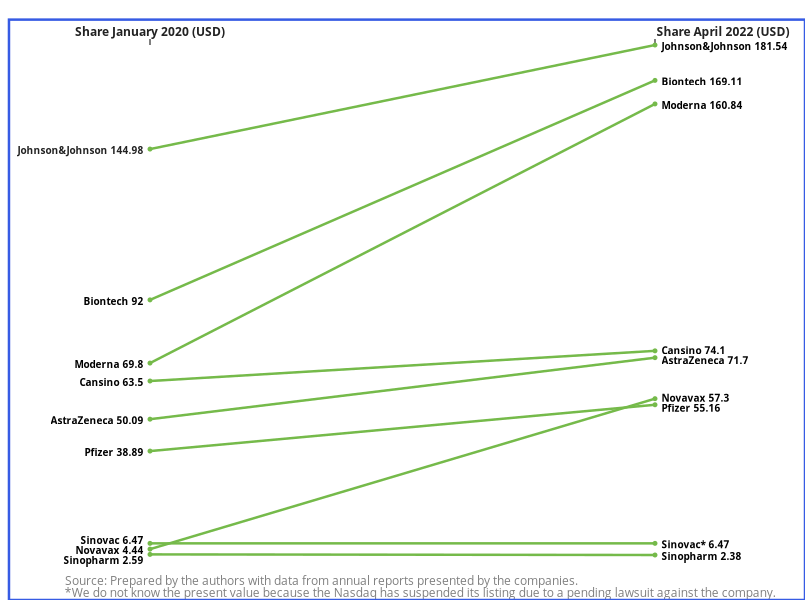

Companies profit with the pandemic

Companies have increased their profits with the development of COVID-19 vaccines. The stock of companies that have WHO-approved vaccines and are listed on the stock exchange have risen in value between January 2020 and May 2022. They have also increased their earnings and sales and the compensation of the persons who manage these companies has increased exponentially. Astra Zeneca reports that, in 2021, product sales grew 41% to 36.541 billion dollars, including revenues from its COVID-19 vaccine. Pascal Soriot y Aradhana Sarin, CEO and CFO of AstraZeneca, in addition to their generous salaries, received additional bonuses equal to 237.5% and 168% of their base salary respectively. In 2021, for the first time, Moderna, Inc. reported a positive net revenue, due to sales of 824 million vaccine doses, of 12.202 billion dollars, 1733% more than in 2020. In 2021, Stephane Bancel, CEO and holder of 4% of Moderna’s shares, joined the exclusive list of the world’s richest persons with equity of 4.9 billion dollars.

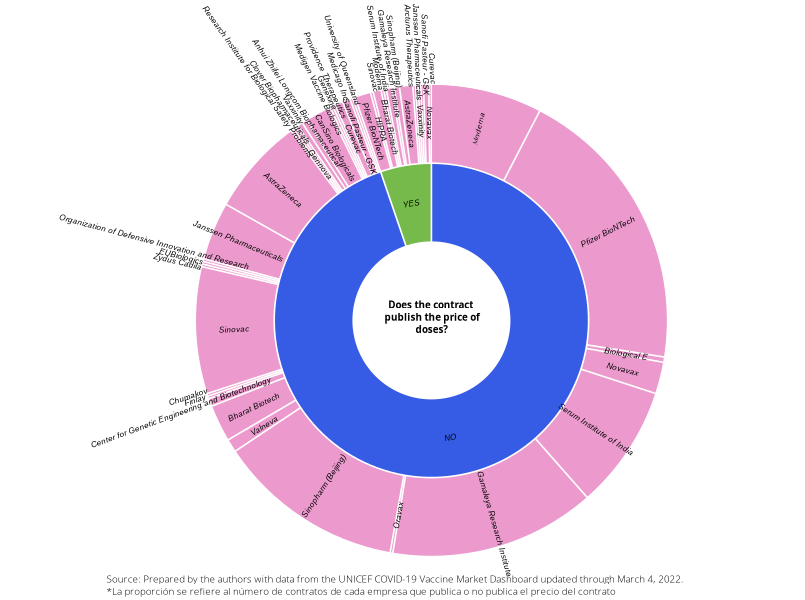

CORPORATE SECRECY. PROTECT COMPANIES BEFORE PEOPLE

Of the 553 agreements for acquisition of vaccines on which we have information, only 29 publish the purchase price agreed for the vaccines. This practice heightens inequalities in access to vaccines. Countries with smaller markets or unable to meet the high costs of vaccines and treatments are left at the end of the line, placing people’s lives at risk.

Who wins with vaccines?

Information on companies’ beneficial owners is scarce and we obtained information on investors in 14 companies that produce vaccines. Most of their investors are private capital investment funds, as well as public capital investment funds and pension fund managers. Of the investors with holdings in more than 3 pharmaceutical companies, 20 invest in AstraZeneca and in Johnson & Johnson, 17 in Pfizer, 14 in Novavax, and 12 in CanSino. Norges Bank Investment Management and The Vanguard Group, Inc. invest in 11 of the 14 pharmaceutical companies we analyzed; Blackrock in 10; and State Street Global Advisors, Inc., and Geode Capital in 7. Blacrock and The Vanguard Group are the world’s largest investment funds.