COVID-19 VACCINES

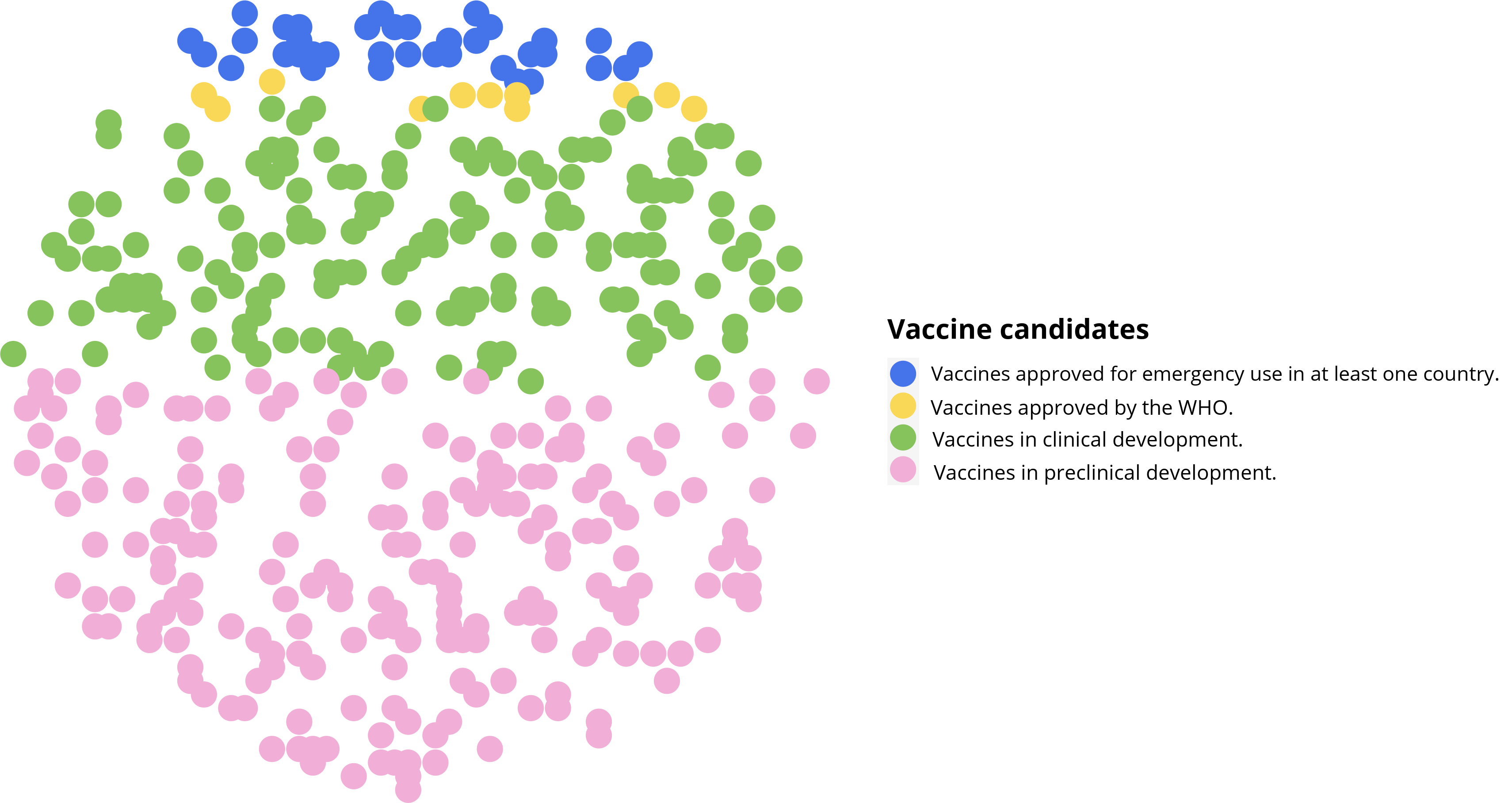

According to the World Health Organization (WHO) as of March 30, 2023, there were 199 vaccine candidates in preclinical development and 183 in clinical development. Of developments that have completed or are close to completing clinical trials, the UNICEF COVID-19 vaccine market dashboard shows that 58 have been approved for emergency use in at least one country. Of those, 11 vaccines are on the WHO emergency use list.

The pharmaceutical industry is highly concentrated

This industry operates practically as a monopoly. The 20 biggest laboratories worldwide concentrate 60% of the pharmaceutical industry’s global sales. These companies have the power to influence global health policy, placing their profits before human lives. As of May 10, 2023, the global administration of vaccine doses has surpassed 13 billions. Yet, there remains a disparity in vaccination rates across different income levels. High and upper-middle-income nations have inoculated a more significant portion of their populations (74.32% and 78.74%) than lower-middle and low-income nations (58.89% and 25.42%).

Companies profit with the pandemic

Companies have increased their profits with the development of COVID-19 vaccines. AstraZeneca reported a 19% increase in revenue in 2022. In December 2022, BioNtech shares hit a high record, trading at USD 185.96. Ugur Sahin, CEO and owner of 17.4% of the company, got a double salary increase. 2022 Pfizer’s revenue totaled $100.33B, up by 23.42% from 2021. CEO Albert Bourla was paid $33.01M, $8M more than the previous year, the highest in Pfizer’s history. Moderna, Inc. reported a revenue of $19.263 million in 2023. This was a 4.29% increase from its earnings in 2021. Stephane Bancel, the CEO of Moderna, has increased his control over the company by acquiring 5.45% of its shares. He is now ranked 568th among the wealthiest people in the world, with an estimated fortune of 4.7 billion dollars.

CORPORATE SECRECY. PROTECTING COMPANIES BEFORE PEOPLE

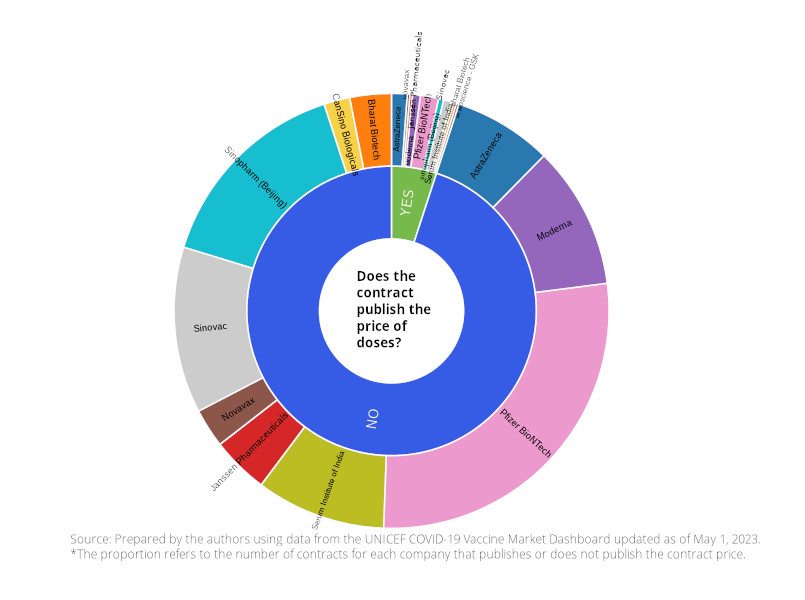

Outside of the 11 vaccines on the WHO emergency use list, the UNICEF COVID-19 vaccine market dashboard provides information on 518 vaccine procurement agreements. However, only 26 of these agreements disclose the purchase price agreed upon for the vaccines. This practice heightens inequalities in access to vaccines. Countries with smaller markets or unable to meet the high costs of vaccines and treatments are left at the end of the line, placing people’s lives at risk.

Who wins with vaccines?

Information on companies’ beneficial owners is scarce. We gathered data from 976 investors who have invested in 35 companies that manufacture vaccines. Most of their investors include private equity and public equity, pension funds and asset managers. Investors in GSK PLC: 120, Johnson & Johnson: 99, AstraZeneca: 97, Pfizer: 83, Moderna: 74. Out of the 35 pharmaceutical companies that were analyzed, The Vanguard Group, Inc. has invested in 17, Blackrock in 16, Norges Bank Investment Management has invested in 14, Dimensional Fund Advisors LP in 14, State Street Global Advisors, Inc. in 11, and Charles Schwab Investment Management, Inc., Geode Capital Management, LLC, and UBS Asset Management AG have invested in 9 each. BlackRock and The Vanguard Group are the two most significant asset managers and investment funds globally.