Pfizer’s billion-dollar monopoly

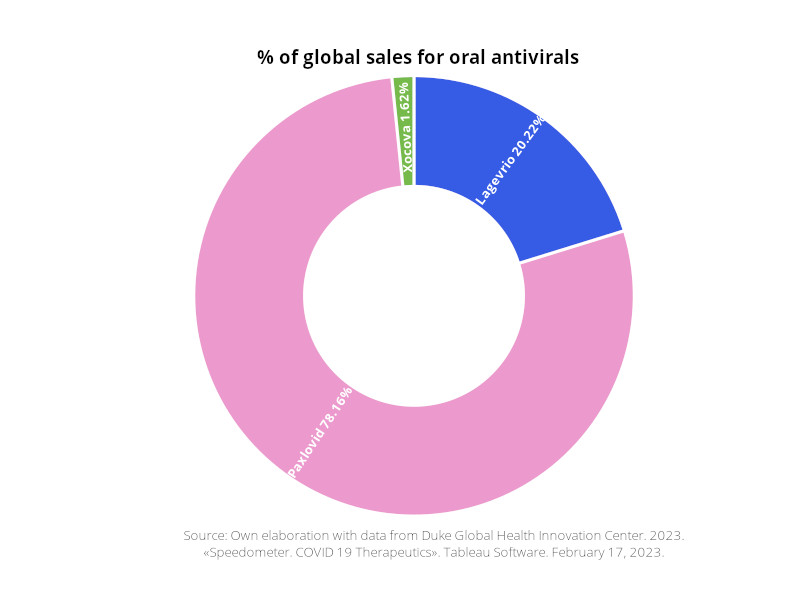

Due to the greater effectiveness of Pfizer’s Paxlovid over other developments, it dominates the antiviral market, controlling 78% of sales. In 2022, Pfizer received revenues of $18.933 billion from the sales of Paxlovid, which corresponds to 18.87% of its total revenue.This amount is comparable to the total economic support provided by the IMF in 2020 to 50 countries to address the ravages of the pandemic. It is slightly higher than the GDP of Albania or Georgia. Pfizer expects sales of Paxlovid to reach $8 billion by the end of 2023.

Who can have access to antivirals?

Like vaccines, high-income countries monopolize oral antivirals, jeopardizing access for low- and middle-income countries with low vaccination rates. Only 2.17% of antiviral sales went to lower-middle-income countries, while 70.31% went to high-income countries.

Two-thirds of antivirals in wealthy countries

High-income countries receive 70.74% of Paxlovid’s sales, with 27.87% going to global entities like UNICEF, Global Fund and the EU Health Preparedness and Response Authority. A small percentage targets upper-middle-income (0.73%) and lower-middle-income countries (0.66%). 67% of Lagevrio is marketed to high-income countries, 24% to global entities (UNICEF), 1.64% to upper-middle-income countries (Malaysia and Thailand), and the remaining 8.35% to lower-middle-income countries (Indonesia, Ukraine, Cambodia, and the Philippines).

.svg)

Mexico manufactures generic drugs but purchases patented ones

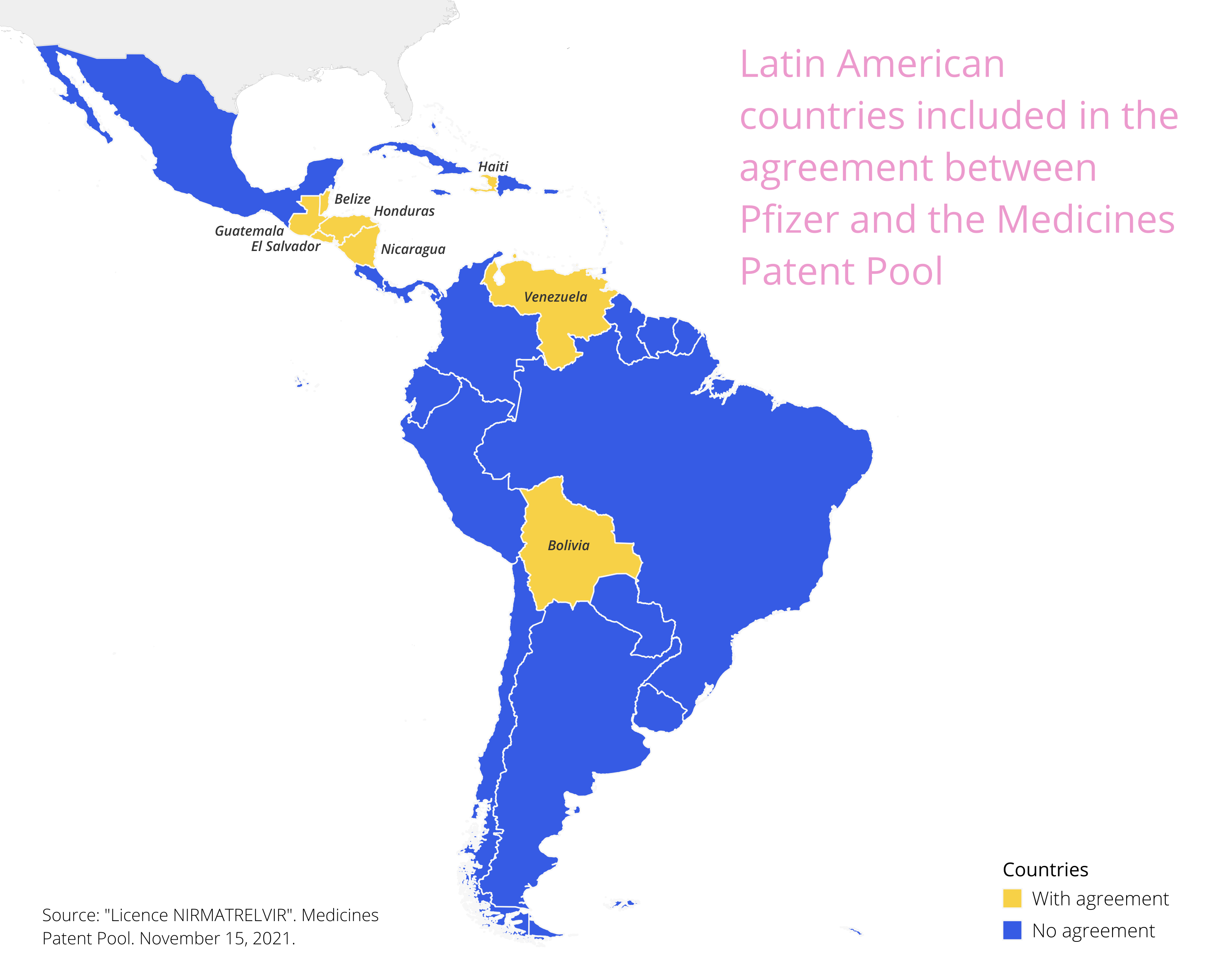

In November 2021, Pfizer granted 35 voluntary licenses for Paxlovid through the Medicines Patent Pool. The Latin American countries where the distribution of the generic has been authorized are Belize, Bolivia, El Salvador, Guatemala, Haiti, Honduras, Nicaragua, and Venezuela. Pfizer has filed patents in excluded countries until 2041, making it impossible for them to acquire the Active Pharmaceutical Ingredient (API) to manufacture the product or its generic version cheaply. The companies producing the generic are located in 12 countries, with only 3 in Latin America: Neolpharma (Mexico), Magnachem (Dominican Republic), and Nortec Química (Brazil). Neolpharma produces generic drugs in Mexico, but the Ministry of Health had to purchase 300,000 patent treatment courses because Mexico is not included in countries with voluntary MPP licenses. If we consider that a course of treatment costs $530 in the US, we could be talking about US$159 million.

Virus of Opacity and Lack of Transparency in Treatments

Public information on contracts for oral antiviral treatments in Mexico has yet to be available despite being purchased with public funds. The total amount spent on the contracts, the price of each course of treatment, and the conditions agreed upon between the government and the pharmaceutical company are unknown. CENAPRECE, in response to the access to information request 330026923000414, indicates that on July 11, 2022, a “Manufacturing and Supply Agreement” was signed, and it’s still in force, between the pharmaceutical company Pfizer Export, BV, and the Ministry of Health as the “PURCHASER” party. The contract is classified as reserved for national security reasons and due to the confidentiality clause imposed by Pfizer for five years, with failure to comply resulting in early cancellation of the contract and lawsuits against the Mexican State.